cap and trade vs carbon tax ontario

For businesses Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances. This is the federal law Progressive Conservative Leader Patrick Brown said in.

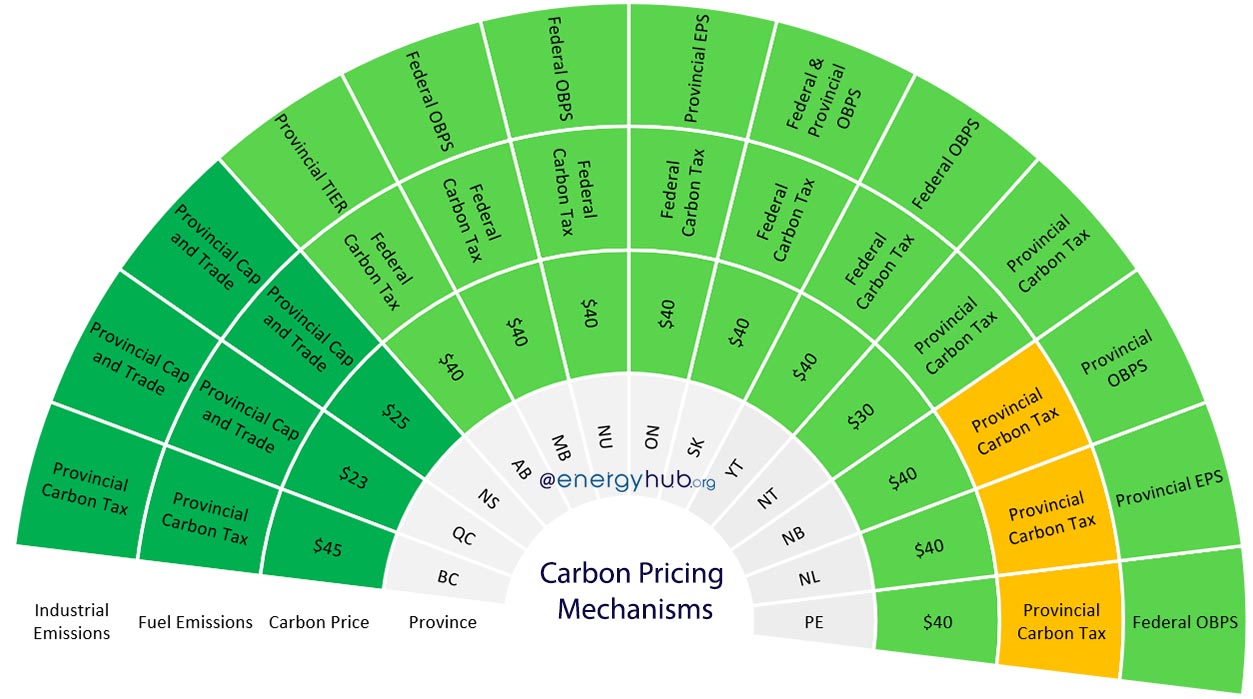

Canadian Carbon Prices Rebates Updated 2021

Learn more about the program and what it means for you and the environment.

. Ontario unveils cap-and-trade plans as provinces take. In Quebec for example businesses that emit 25000 metric tons of carbon dioxide or more are subject to the cap-and-trade system. Under the federal governments carbon tax favoured by the PCs Ottawa has said provinces must choose between cap and trade and a carbon tax the price would be 50 a tonne by 2022.

The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of reducing the buildup of greenhouse gas emissions. In April Liberal Leader Steven Del Duca told The Narwhal that he wants to avoid the whiplash cycle of governments of different parties continuously. No matter how much gets emitted a carbon tax makes the emission the same.

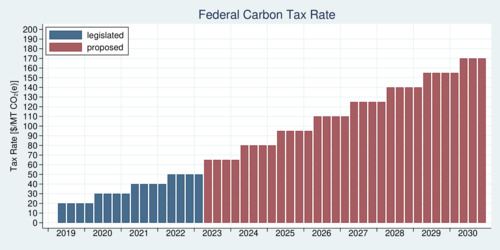

The federal carbon tax will cost a typical household 258year in 2019 and will rise to 648 by 2022. Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways. The following are the authors final thoughts on the.

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. The total compensation amount is 5090000 for a total of 27 participants. The orderly wind down of the cap-and-trade carbon tax is a key step towards fulfilling the governments commitment to reducing gas prices by 10 cents per litre.

Cap-and-trade is a complex alternative to carbon tax in Ontario but only small end-users will pay for emission allowances in natural gas and transport fuel. Cap-and-Trade systems limit the amount of carbon dioxide that gets emitted but gives little control to the price. The Proposed Act will repeal the cap and trade regime enacted under the previous governments Climate Change Mitigation and Low-carbon Economy Act 2016 the CCM Act and will retire or cancel the various cap and trade instruments ie emissions allowances and offset credits the Instruments currently held by Ontario participants.

Peter MacdiarmidGetty Images G r. What you need to know about Ontarios carbon market using a cap and trade program including how it works and who is required to participate. The Liberals 2022 Ontario election platform calls for strengthening the Tories current industrial carbon pricing system rather than returning to the cap-and-trade method Ford scrapped.

We have developed a plan to wind down the program. It is estimated that the current cap-and-trade system would reduce Ontarios domestic emissions by about 5 megatonnes per year by 2022. The only difference is cap and trade.

On October 31 Ontario passed the Cap and Trade Cancellation Act 2018 that officially removed Ontarios cap and trade program law from the books. 1 Effects of Emissions Trading and a Carbon Tax. Canadas federal carbon tax increases on April 1.

Learn the basics of cap and trade Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances. 11 Price and Quantity. The paper is written by the Chambers Senior Economist Tina Kremmidas.

With the passage of Bill 4 The Cap and Trade Cancellation Act the Cap and Trade Cancellation Act on October 31 2018 the Government of Ontario formally repealed the Ontario cap and trade regime 1 and brought Ontarians and Ontario businesses into the federal carbon pollution pricing regime the Federal Carbon Pricing Regime introduced in the. A straight carbon tax at 50 per tonne would reduce. Thats because cap and trade is a carbon tax by another name.

The cap and trade program is a central part of Ontarios solution to fight climate change. Or use a cap-and-trade system that achieves the same result. A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives firms and households depending on the scope an incentive to reduce pollution whenever doing so would cost less than.

Simply put Premier Kathleen Wynne has imposed a new 19 billion annual tax on all Ontarians. Carbon taxes makes emitting carbon dioxide more expensive. The advantage of a carbon tax compared with cap and trade is that it is relatively easy to administer and straightforward to understand.

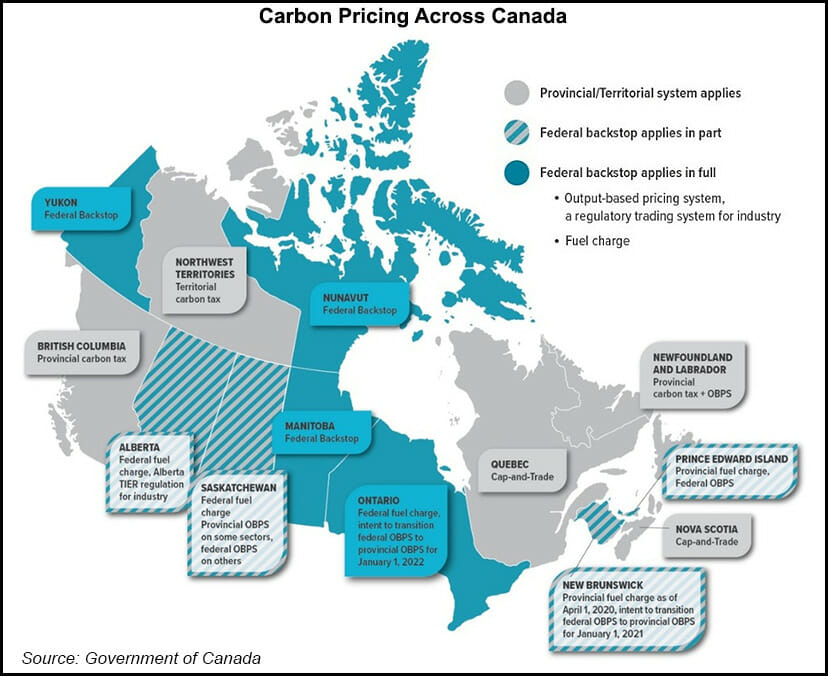

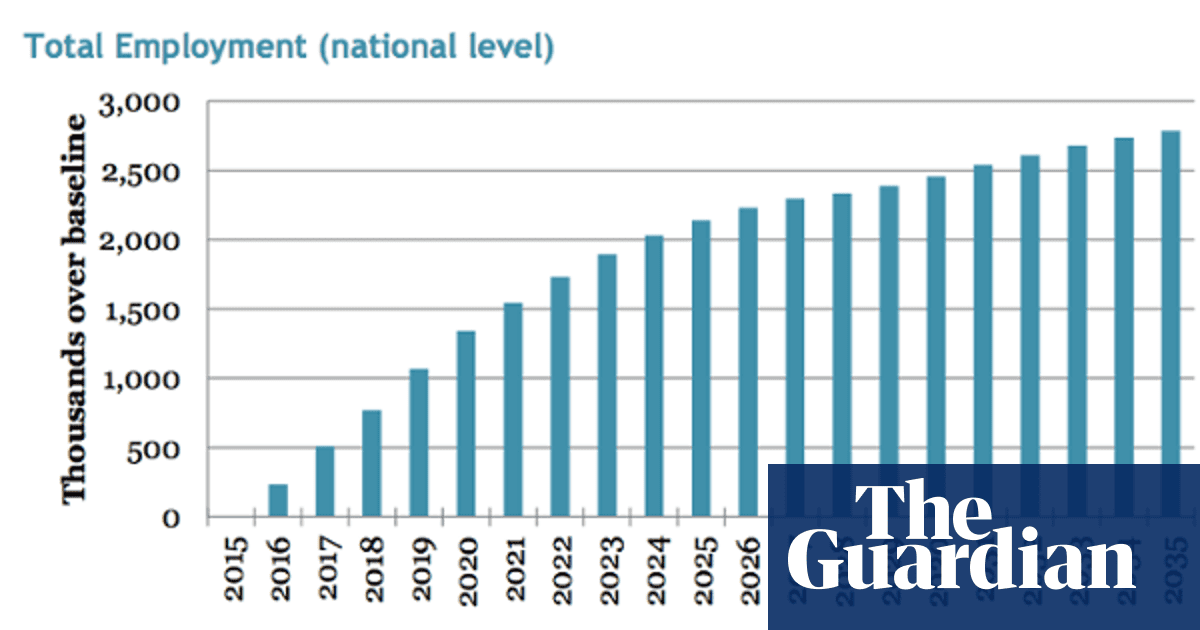

If a province has no plan or if its below the standard the federal. In addition to saving families money the elimination of the cap-and-trade carbon tax will remove a cost burden from Ontario businesses allowing them to grow create jobs and compete. A Carbon Tax vs Cap-and-Trade.

Ontarios pending cap-and-trade system will initially function as an elaborate structure for applying a carbon tax on fossil fuels while creating an avenue for. We have developed a plan to wind down the program.

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Carbon Markets Putting A Price On Carbon Green City Times

Here S What We Know And Don T Know About Alberta S Carbon Tax

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

Carbon Pricing Vs Carbon Tax Understanding The Difference 2021 04 14 Engineered Systems Magazine

In Charts How A Revenue Neutral Carbon Tax Creates Jobs Grows The Economy Carbon Tax The Guardian

All You Need To Know About Bc S Carbon Tax Shift In Five Charts Sightline Institute

Where Carbon Is Taxed Overview

Canada S Carbon Pricing Is Continuing On The Right Track

Where Carbon Is Taxed Overview

Clarifying The Carbon Tax In The Case Of Canada Ualberta Sustain Su Sustainability Blog

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

Where Carbon Is Taxed Overview

Carbon Pricing Is Here To Stay In Canada What Is It Anyway Youtube